Are you in need of quick cash without the headache of traditional loan processes? Look no further than PalmPay! With PalmPay, borrowing money is easy, fast, and stress-free. As a fully licensed Mobile Money Operator by CBN and insured by NDIC, PalmPay ensures a secure and reliable borrowing experience.

How to Borrow Money from PalmPay in 6 Simple Steps

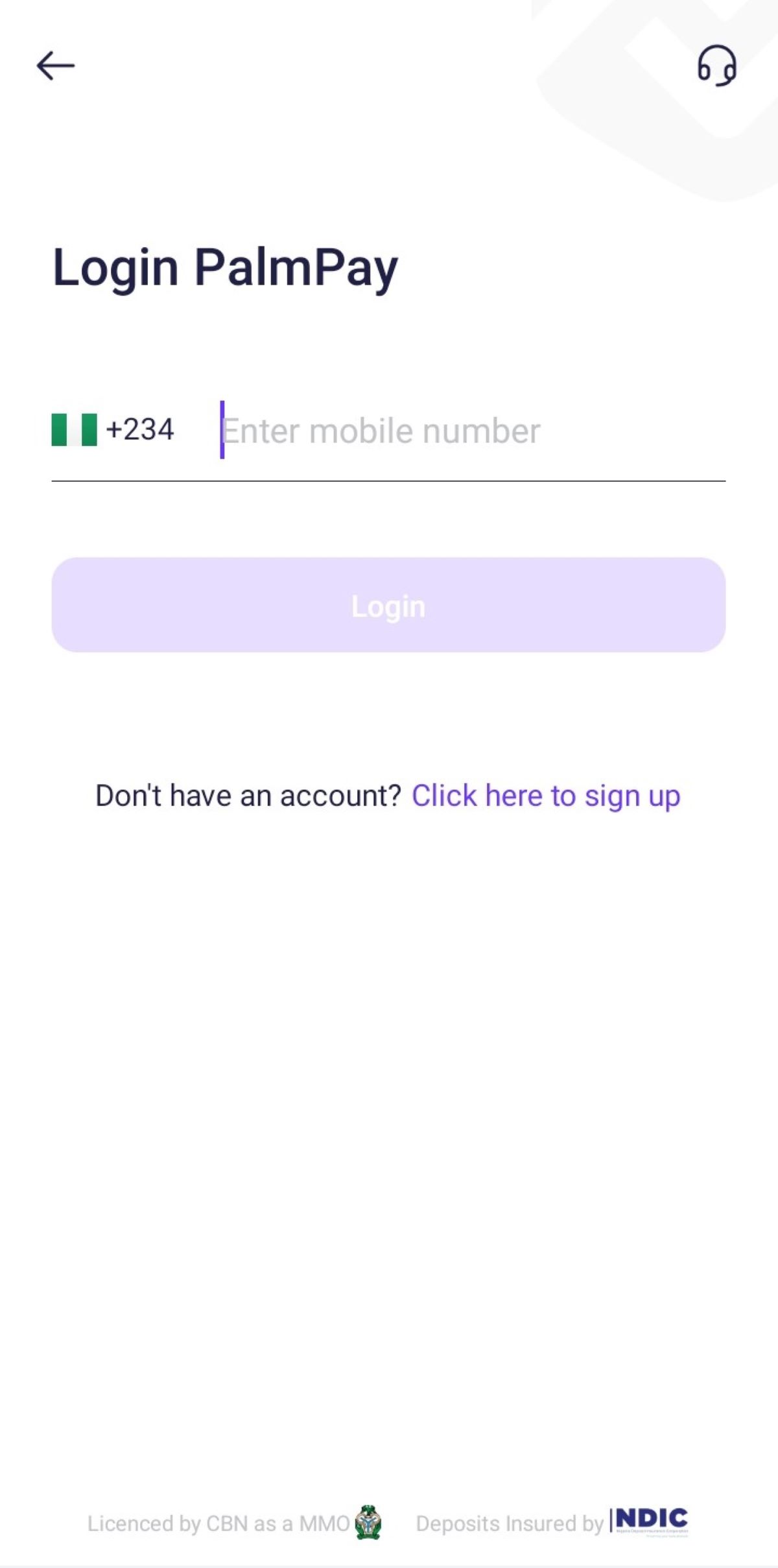

- Log into Your PalmPay App: Start by logging into your PalmPay account using your credentials. Don’t have an account yet? Sign up to get started hassle-free.

- Click on the “Loan” Section: Once logged in, locate and click on the “Loan” section within the PalmPay app. Choose “Get Flexi Loan Now” to proceed.

- Enter Your Loan Amount: Complete the necessary details, including face verification and contact information. PalmPay will send a One Time Password (OTP) for verification.

- Review Loan Terms and Conditions: Carefully review the terms and conditions associated with the loan. Understand the interest rates, repayment terms, and other important details.

- Click on “Apply Now”: If you’re satisfied with the loan terms, click on the “Apply Now” button to proceed with your application.

- Get Your Loan: Upon approval, the borrowed funds will be deposited into your PalmPay account. Use these funds for emergencies, bills, or any other financial needs.

How to Borrow Money on PalmPay Without BVN

Don’t have a BVN? No worries! Follow these simple steps to borrow money on PalmPay without BVN:

- Dial *652# on your phone and press the call button.

- Select “loan” and follow the prompts to provide your details.

- Review the terms and confirm your application to proceed.

Note: While borrowing without a BVN is possible, linking your BVN may increase your borrowing limit.

PalmPay Loan Eligibility & Requirements

To borrow a loan from PalmPay, you must meet the following requirements:

- Nigerian citizenship and residency.

- Minimum age of 22 years.

- A functioning phone to download the PalmPay app.

- Good credit score with no pending loans.

- An active bank account with BVN.

Repaying Your PalmPay Loan

Repaying your loan on PalmPay is simple:

- Open the app and log in.

- Navigate to the “Loans” section.

- Choose the loan you need to repay.

- Select your preferred repayment method (wallet or bank transfer).

- Enter the amount and confirm the transaction.

FAQ

-

What are the loan amounts and repayment terms offered by PalmPay?

- Loan amounts range from ₦3,000 to ₦50,000 with repayment terms of 91 days to 365 days.

-

What is the interest rate on PalmPay loans?

- PalmPay loans carry an interest rate between 15% to 30%, varying based on the loan amount and credit score.

-

What happens if I miss a payment?

- Missing payments may result in additional charges, so it’s essential to stay on track with your repayment schedule.

Conclusion

Borrowing money doesn’t have to be a complicated process. With PalmPay, you can access fast and convenient loans with flexible repayment options. Whether you need cash for emergencies or everyday expenses, PalmPay has you covered. Simply follow the easy steps outlined above to get the funds you need, when you need them, hassle-free