In today’s world, financial needs can arise unexpectedly. Whether it’s an urgent bill, a business opportunity, or simply making ends meet amidst rising expenses, having access to quick and reliable loans can be a lifesaver. Luckily, with the advent of loan apps, getting the financial assistance you need has never been more convenient. In this guide, we’ll walk you through the top-rated loan apps in Nigeria, ensuring you make informed decisions and borrow responsibly.

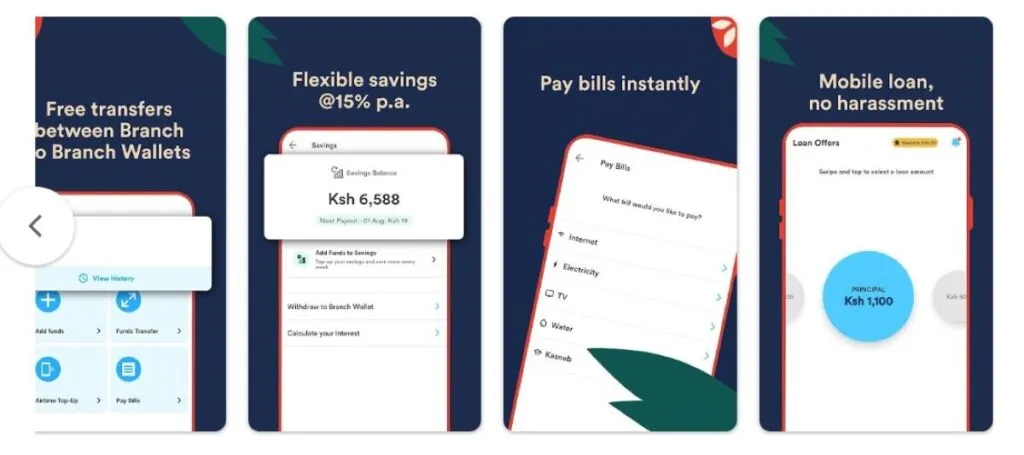

Branch Loan App

Branch is a trusted name in the world of lending, licensed by the Central Bank of Nigeria. With over 10 million downloads and a stellar 4.5-star rating, Branch offers loans ranging from ₦2,000 to ₦500,000, with repayment periods of 61-180 days. Their quick approval process ensures you get the funds you need within minutes.

Carbon Loan App

Carbon, formerly known as Paylater, is another popular choice for borrowers. With over 1 million downloads and a rating of 4.3 stars, Carbon provides loans without collateral, ranging from ₦1,500 to ₦1 million. While their interest rates are competitive, some users have reported delays in loan confirmation.

FairMoney Loan App

FairMoney simplifies the loan process, offering loans of up to ₦1,000,000 for individuals and ₦5,000,000 for SMEs. With a user-friendly interface and quick approval times, FairMoney is a go-to option for many borrowers in Nigeria.

Aella Credit Loan App

Aella Credit stands out with its comprehensive range of personal and business loans, catering to various loan demands. With over 1 million downloads and a rating of 3.2 stars, Aella Credit offers loans ranging from ₦1,500 to ₦1,000,000, making it a versatile choice for borrowers.

PalmPay

PalmPay not only offers loans but also provides bill payment and investment services. With loans up to ₦1 million and a competitive interest rate, PalmPay is a convenient option for those seeking financial assistance.

Opay (Okash Loan App)

Under the umbrella of Opay, Okash offers instant loans up to ₦500,000 with interest rates ranging from 10% to 30% per month. With a user-friendly interface and a rating of 4.4 stars, Okash is a reliable choice for borrowers.

Alat by Wema Bank

Alat blends digital banking with lending services, offering a variety of loans including salary-based and business loans. With over 1 million downloads and a rating of 3.9 stars, Alat provides convenience and flexibility to borrowers.

PalmCredit

PalmCredit offers small, short-term loans ranging from ₦2,000 to ₦100,000 with interest rates between 14% and 24%. With a straightforward approval process, PalmCredit is ideal for those in need of urgent financial assistance.

CredPal

CredPal provides collateral-free loans of up to ₦500,000 with interest rates ranging from 4% to 9%. Additionally, they offer a Buy Now Pay Later service, making them a versatile choice for borrowers.

Renmoney

Renmoney offers loans of up to ₦6,000,000 without collateral, with repayment periods ranging from 3 to 24 months. With a rating of 3.9 stars, Renmoney is a trusted option for borrowers seeking higher loan amounts.

Conclusion

With the proliferation of loan apps in Nigeria, accessing financial assistance has become more convenient than ever. However, it’s essential to choose the right app that suits your needs and offers favorable terms. By considering factors such as interest rates, repayment terms, and user reviews, you can make informed decisions and borrow responsibly.

FAQs

1. How quickly can I expect loan approval?

Loan approval times vary depending on the app, but many offer instant to a few hours approval, ensuring you get the funds you need quickly.

2. What documents do I need to provide for loan applications?

Generally, you’ll need a valid identification such as a National ID or Passport, proof of income (optional), and bank account details. Some apps may require additional documentation for verification purposes.

3. Are these loan apps secure?

Yes, reputable loan apps employ robust security measures to protect your personal and financial information. However, it’s essential to read the app’s privacy policy and ensure they comply with regulatory standards