In Nigeria, accessing loans used to be a cumbersome process involving lots of paperwork and collateral requirements. However, thanks to the emergence of various loan apps, getting a loan has become more convenient and hassle-free. These apps have revolutionized the lending landscape by offering quick and easy access to funds, often without the need for collateral or extensive documentation.

Top 7 Loan Apps in Nigeria:

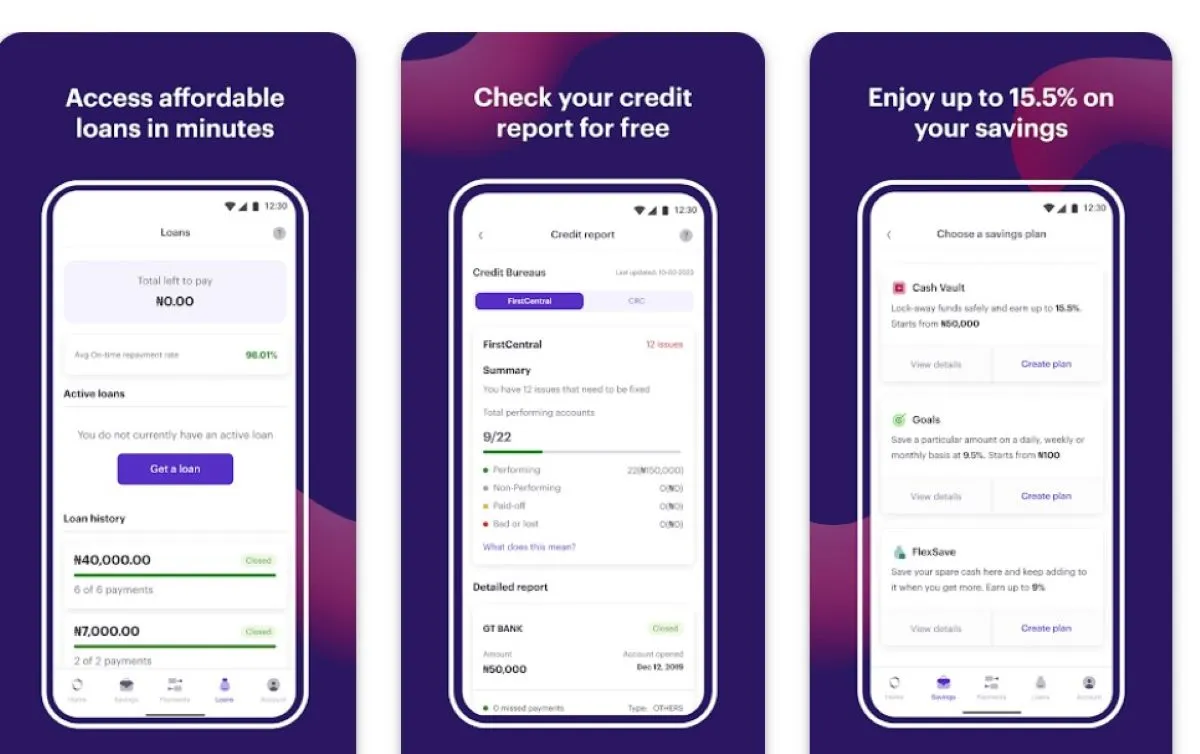

Carbon (Paylater):

Formerly known as Paylater, Carbon is a leading loan app in Nigeria that offers loans ranging from ₦1,500 to ₦1 million. These loans are tailored to meet urgent financial needs and come with flexible repayment options spanning up to 64 weeks. Carbon charges interest rates ranging from 1.75% to 30% per month.

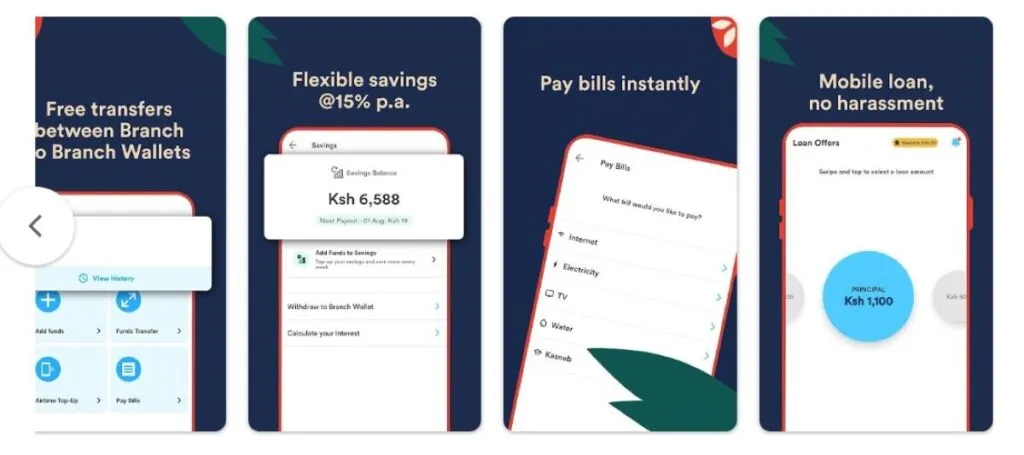

Branch:

Branch provides instant loans of up to ₦500,000 with interest rates varying from 2% to 18%. The loan tenure can range from 62 days to 1 year, depending on the customer’s risk profile. Similar to Carbon, Branch offers quick access to funds without the need for collateral.

Aella Credit:

Aella Credit offers loans ranging from ₦2,000 to ₦1.5 million with repayment tenors of 61 days to 365 days. The app charges monthly interest rates ranging from 2% to 20% and offers an early repayment discount of up to 60%.

KiaKia:

KiaKia provides both business and personal loans, with amounts reaching as high as ₦100 million. The loan tenure ranges from 30 days to 24 months, with flexible interest rates starting as low as 6.5%.

XCredit:

XCredit offers loans of up to ₦500,000 with no collateral required, only bank details. The loan tenure spans about 5 months, and the app charges an interest rate of 12% of the borrowed amount.

PalmPay:

PalmPay allows users to access instant loans of up to ₦200,000 without any paperwork or collateral requirements. The app charges interest rates ranging from 15% to 30%, influenced by the borrower’s credit score and loan amount.

9ja cash:

With 9ja cash, borrowers can access loans of up to ₦300,000 with a repayment term of 91 to 720 days. The app charges annual interest rates ranging from 10% to 28%.

Conclusion:

The emergence of loan apps in Nigeria has transformed the way individuals access financial resources. These apps provide a convenient and streamlined alternative to traditional lending methods, offering quick and easy loans without the hassle of collateral or extensive paperwork. Whether it’s for personal or business needs, these loan apps offer accessible financial solutions to Nigerians.

FAQs:

1: Are these loans safe to use?

Yes, these loan apps operate within the regulatory framework set by the Central Bank of Nigeria (CBN) and adhere to strict security protocols to ensure the safety of users’ personal and financial information.

2: Can I get a loan with a poor credit score?

Some loan apps consider factors beyond credit scores, such as transaction history and income levels, making it possible for individuals with less-than-perfect credit to access loans.

3: How quickly can I receive the loan funds?

The speed of loan disbursement varies among different apps, but many offer instant or same-day loan approval and disbursal, ensuring that borrowers can access funds quickly when needed.