Access Bank stands as a beacon of financial empowerment, offering an array of loan products tailored to meet diverse needs. Whether you’re an individual seeking personal financial solutions, a small business owner in need of operational support, or even a larger corporation looking for strategic financing, Access Bank has something for you.

Here’s a breakdown of the loan types Access Bank offers and what they entail:

Personal Loans:

Access Bank’s Personal Loans cater to various individual financial needs. They offer swift solutions for short-term financial gaps, with flexible repayment periods of up to six months. The best part? No collateral or extensive documentation required, making them ideal for emergencies or quick financial assistance.

Vehicle Loans:

Designed for those looking to purchase new or used vehicles, Access Bank’s Vehicle Loans require applicants to provide a pro forma invoice from an approved car vendor. Credit checks are part of the application process to ensure financial stability and repayment capability.

Home Loans:

Access Bank’s Home Loans are tailored for those looking to buy or build properties. With comprehensive documentation requirements, including mortgage application forms and property title documents, this product ensures a secure and responsible lending process for long-term property investment.

W Power Loan:

Specifically designed to support women in business, the W Power Loan offers financial assistance for asset acquisition, infrastructure upgrades, and operational costs. Eligible businesses must have at least 50% female ownership, promoting gender equality in business financing.

Maternal Health Service Support (MHSS):

This loan assists women in affording fertility treatments, supporting women’s health and family planning endeavors. Documentation such as medical bills and employment verification is required to ensure the loan is used for its intended purpose.

Access More Mileage:

This car financing scheme offers structured repayment plans for purchasing new vehicles, making it an attractive option for those seeking reliable financing for their car purchases.

Creative Sector Loans:

Tailored for industries such as fashion, IT, movie production, music, and software engineering, these loans provide much-needed financial support for creative endeavors, enabling artists and creators to expand their businesses and projects.

Device Finance Loan:

Available to Access Bank customers with a salary account, this loan facilitates the purchase of mobile devices or MTN airtime bundles, offering specific terms including interest rates and penalties for late repayment.

Lending Against Turnover (LATO) Loan Service:

Offering quick access to funds based on account turnover, LATO is available to all Access Bank customers with an active account for at least six months, requiring no formal documentation or collateral.

Access Bank Eazy Buy Finance Scheme Loan:

Tailored for salary earners or verified business owners, this loan facilitates the purchase of GAC motors, supporting personal and business mobility needs with manageable repayment terms.

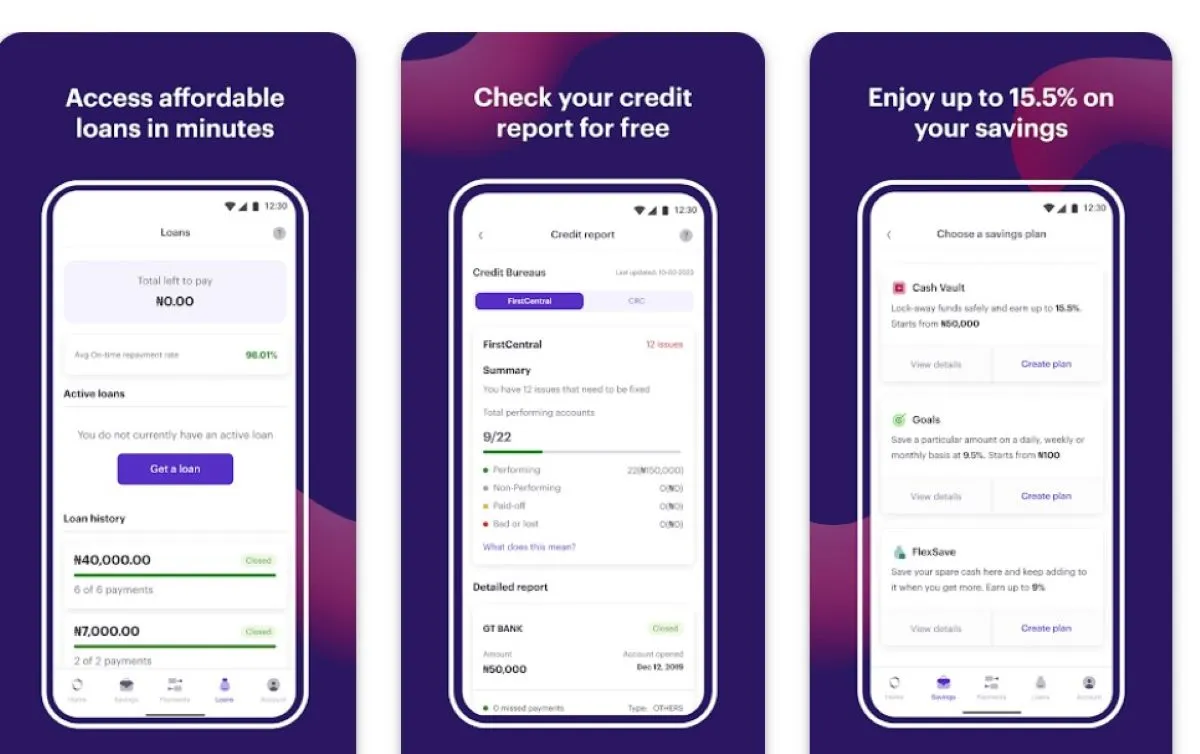

Small Ticket Personal Loan:

Ideal for salary earners, this loan offers up to 400% of your monthly salary, capped at ₦2,000,000, with a 12-month tenure and convenient application through USSD code or QuickBucks.

Payday Loan:

A short-term borrowing option with high-interest rates, the Payday Loan extends credit based on a borrower’s income and credit profile, typically repaid with the next paycheck.

Conclusion:

Access Bank’s diverse range of loan products caters to the varied needs of individuals, SMEs, and larger corporations, offering convenient and reliable financial solutions for various purposes. Whether you’re looking to fund a personal endeavor, purchase a vehicle, or expand your business, Access Bank has you covered.

FAQs:

1. How can I apply for an Access Bank loan?

You can apply for an Access Bank loan through various channels, including online platforms like the QuickBucks App or USSD codes, as well as visiting a branch. Each loan type may have specific eligibility criteria and documentation requirements.

2. What documents do I need to submit for a Home Loan?

For a Home Loan, you’ll typically need to submit mortgage application forms, employer’s confirmation, property title documents, and valuation reports. These documents help ensure a secure lending process for long-term property investment.

3. Can I get a loan if I don’t have collateral or extensive documentation?

Yes, Access Bank offers loan products like Personal Loans that don’t require collateral or extensive documentation, making them ideal for emergencies or quick financial assistance. However, eligibility criteria may vary depending on the loan type and amount