Education is essential, but rising costs can make it challenging for many Nigerian students to pursue their academic dreams. However, thanks to the emergence of student loan apps, financing education has become more accessible than ever before. In this guide, we’ll explore the top 10 student loan apps in Nigeria, helping students find the right financial support to continue their studies.

Top 10 Student Loan Apps in Nigeria:

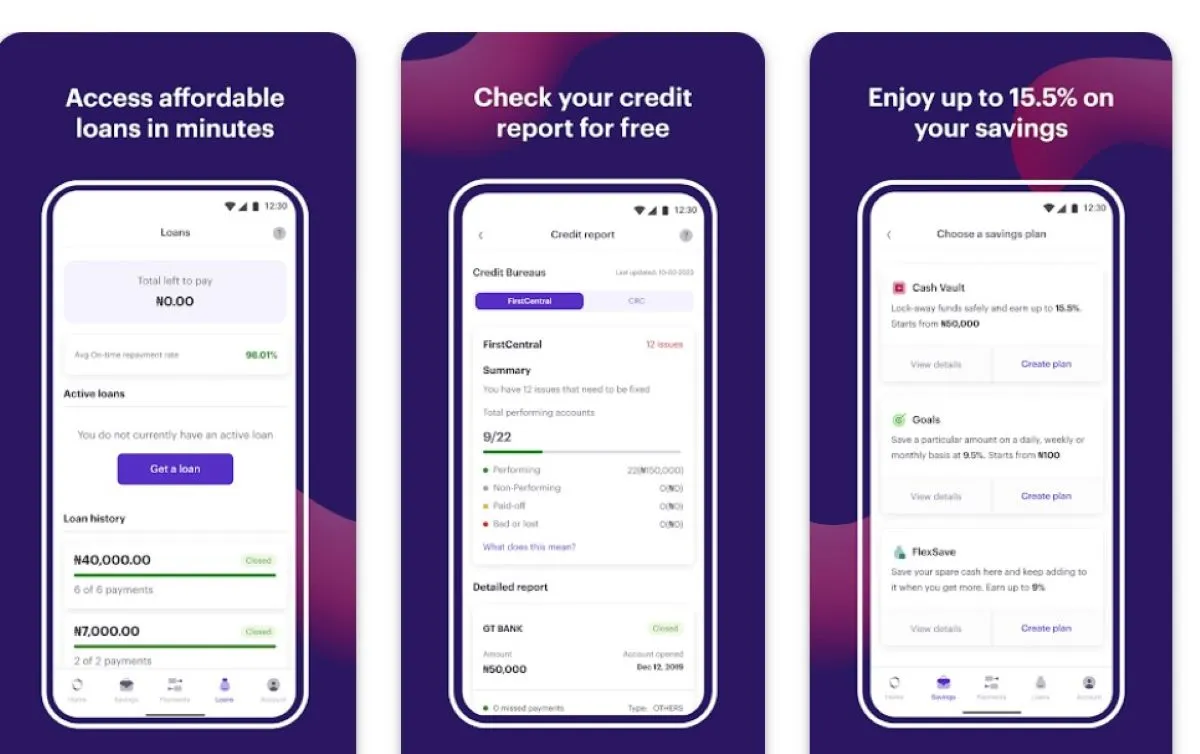

Carbon Loan App:

Carbon is a popular loan app in Nigeria, offering individual loans, including for educational purposes. With loans ranging from N1,500 to N1,000,000, Carbon provides flexibility and convenience for students. The app’s simple application process and competitive interest rates make it a go-to choice for many.

Okash:

Formerly a subproduct of OPay, Okash now stands as a standalone app providing loans of up to N500,000. It’s a convenient option for students with its straightforward eligibility requirements and flexible repayment terms.

FairMoney:

FairMoney stands out for its reliability, offering loans from ₦10,000 to ₦500,000 with competitive interest rates. The app’s user-friendly interface and quick loan processing make it a preferred choice among students.

PalmCredit:

PalmCredit caters to students’ financial needs by offering loans of up to ₦100,000 at reasonable interest rates starting at 14%. Its credit scoring system rewards responsible borrowing, making it an attractive option for long-term financial support.

Branch:

Branch provides student loans ranging from ₦1,000 to ₦500,000 with reasonable interest rates starting at 15%. Its no-paperwork, no-collateral policy makes it an excellent choice for students seeking hassle-free financial assistance.

Renmoney:

Renmoney offers loans from ₦6,000 to ₦6 million at competitive interest rates, starting at 4.5%. With flexible repayment terms and no need for collateral, Renmoney provides a convenient solution for students’ financial needs.

Kiakia:

Kiakia offers peer-to-peer lending opportunities, connecting borrowers with lenders without collateral requirements. While its loan amounts start at N50,000, the platform provides fast loan approval and disbursement, ideal for urgent financial needs.

Aella Credit:

Aella Credit provides substantial loans ranging from ₦100,000 to ₦1 million with competitive interest rates. Its convenient online application process and quick loan disbursement make it a popular choice among students.

Migo Loan:

Migo offers suitable loans for students, ranging from N500 to over N500,000. With a user-friendly web interface and mobile app, Migo provides easy access to funds with flexible repayment options.

QuickCheck:

QuickCheck offers student-friendly loans of up to ₦500,000 with interest rates ranging from 2% to 30%. Its simple application process and quick disbursement make it a convenient option for students in need of financial support.

How to Choose the Right Student Loan App:

When selecting a student loan app, consider factors such as interest rates, loan amounts, repayment terms, charges, credit score requirements, application process, loan disbursement time, and customer support. Choose an app that aligns with your financial needs and offers the best terms for your situation.

Conclusion:

Student loan apps have revolutionized educational financing in Nigeria, providing students with convenient access to funds for their academic pursuits. By exploring the top 10 loan apps listed above and considering key factors, students can find the right financial support to continue their education without unnecessary financial burden.

FAQs:

1.Are these student loan apps safe to use?

Yes, these loan apps prioritize user security and data privacy, employing encryption and other security measures to safeguard users’ information.

2.What are the eligibility requirements for obtaining a loan?

Eligibility requirements vary among loan apps but commonly include Nigerian residency, a valid ID card, a steady source of income, and a Bank Verification Number (BVN).

3.Can international students in Nigeria access these loan apps?

Some loan apps may have specific eligibility criteria, so it’s essential to check individual app requirements. However, many loan apps are accessible to Nigerian residents, including international students, provided they meet the necessary criteria