In Nigeria, getting a loan used to be a cumbersome task, involving tons of paperwork and often, collateral. But thanks to the innovative FairMoney loan app, those days are behind us. FairMoney offers a seamless way for Nigerians to access instant cash without the hassle.

Here’s how you can get started:

- Download the App: Head over to the Google PlayStore and download the FairMoney app on your Android device.

- Sign Up or Log In: Once you have the app, sign up with your phone number or Facebook profile. If you’re a returning user, simply log in.

- Apply for a Loan: Whether you’re a new user or returning, you can apply for a loan right within the app.

- Receive Funds: After a quick verification process, you’ll receive the loan amount directly into your bank account within minutes.

What Can You Expect from FairMoney?

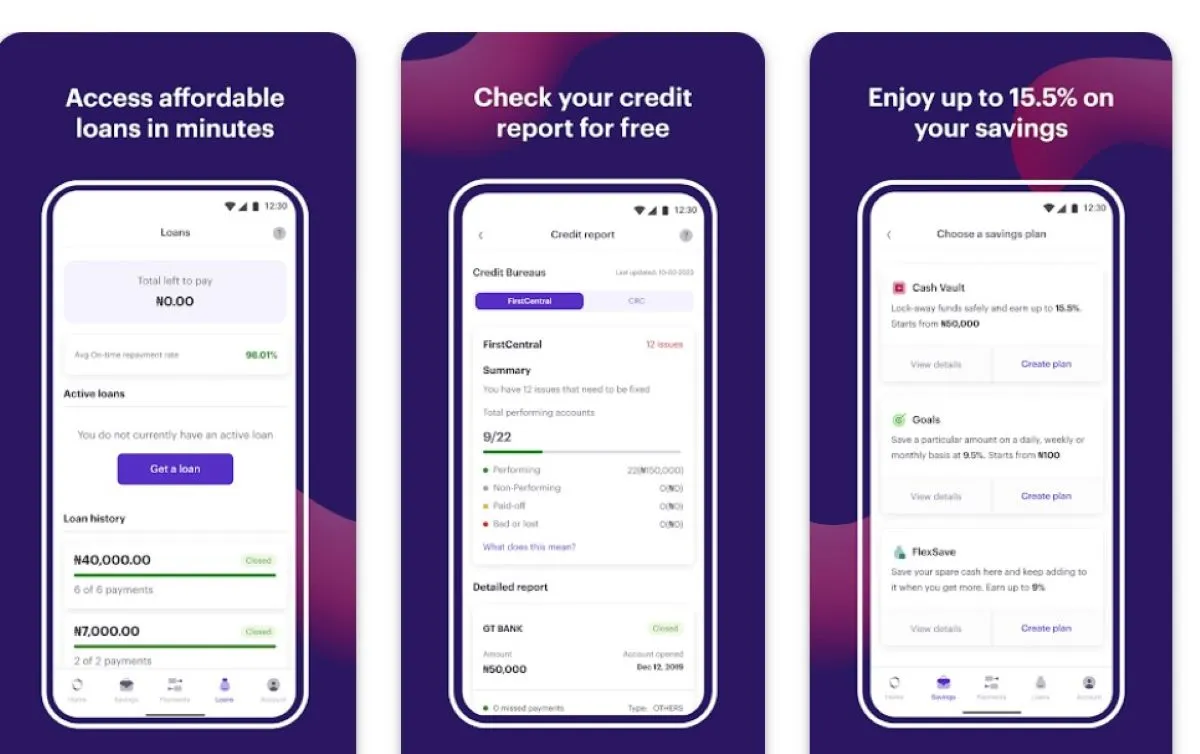

FairMoney offers loans ranging from ₦1,500 to ₦500,000, with durations of up to 60 days and beyond. The interest rates are reasonable, typically between 10% to 30% monthly. Plus, there are no hidden fees or additional costs involved in the loan processing.

Key Features of FairMoney:

- Instant loan disbursement

- No collateral required

- Minimal documentation

- Accessible to all, regardless of credit history

Understanding Loan Limits and Interest Rates:

New users might start with lower loan limits, but these increase over time based on your repayment behavior. FairMoney offers loans of up to N3,000,000 with a repayment period of 24 months. Interest rates vary depending on the loan amount and duration, typically ranging from 2.5% to 30%.

What if You Can’t Repay on Time?

FairMoney understands that life can be unpredictable. If you find yourself unable to repay on time, late fees may apply. Your FairMoney account may also be temporarily suspended, and in serious cases, you could be reported to the national credit bureau.

Conclusion:

FairMoney has revolutionized the lending landscape in Nigeria, offering a convenient and reliable solution for instant cash needs. With no collateral requirements and minimal documentation, getting a loan has never been easier. Whether it’s for emergency expenses or personal investments, FairMoney has got you covered.

FAQ:

1.How much can I borrow from FairMoney?

FairMoney offers loans ranging from ₦1,500 to ₦500,000, with higher limits available for returning users based on their repayment behavior.

2.What are the interest rates?

Interest rates vary from 2.5% to 30% depending on the loan amount and duration. The exact rate will be communicated during the application process.

3.What happens if I miss a repayment?

Missing a repayment may result in late fees, temporary account suspension, and reporting to the national credit bureau. It’s essential to communicate with FairMoney if you anticipate difficulties in repayment