In today’s digital age, banking has become more convenient than ever before. With the rise of digital banks like ALAT by Wema, managing your finances is as simple as a few taps on your smartphone. But what exactly is ALAT, and how can it benefit you? Let’s break it down in easy-to-understand terms.

What is ALAT by Wema?

ALAT is not your traditional brick-and-mortar bank; it’s a digital bank that exists entirely within your smartphone. Imagine having access to all your banking needs right at your fingertips, without ever needing to visit a physical branch. That’s the beauty of ALAT.

What Services Does ALAT Offer?

ALAT offers a range of services designed to make your banking experience seamless:

- Payments and Transfers: Easily move funds between your accounts or make payments to third parties with just a click. You can even fund your ALAT account using cards from other banks.

- Debit Cards: ALAT provides both personal and corporate debit cards with zero monthly fees, so you can swipe without worrying about extra charges.

- Savings and Goals: Set up savings goals to help you achieve your financial dreams, whether it’s a vacation or a new gadget. ALAT makes saving simple and achievable.

- Bulk Transactions for Businesses: If you’re a business owner, ALAT allows you to execute bulk transactions of over N2 Billion right from your smartphone, no matter where you are in the world.

- Loans: Need some extra cash? ALAT offers instant loans with low-interest rates, so you can cover unexpected expenses with ease.

How Can I Get Started with ALAT?

Getting started with ALAT is easy:

- Download the App: Simply download the ALAT mobile app from the App Store or Google Play Store.

- Register: Fill in the registration form with your details and wait for verification. You can even open a business account using the same process.

Requirements for Registration:

To register successfully, you’ll need:

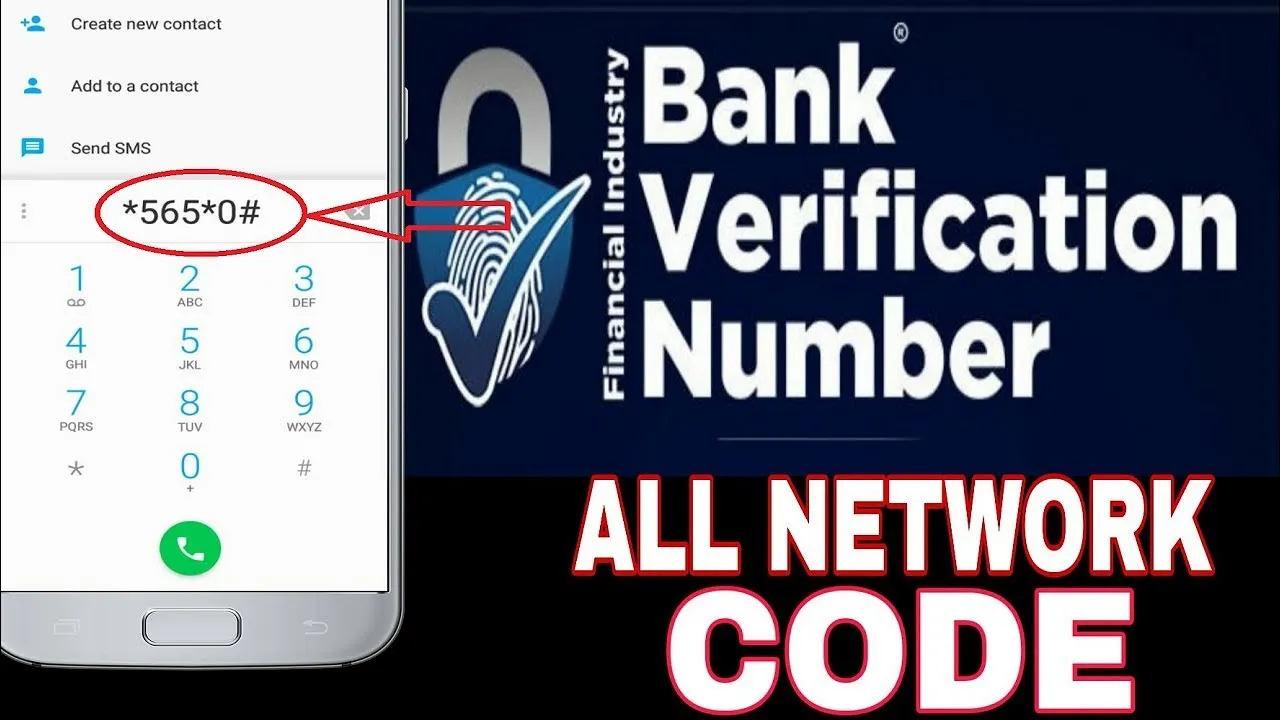

- Your Bank Verification Number (BVN)

- A clear picture of your face, name, phone number, and email address

Once your details are verified, create a password to secure your account.

Borrowing a Loan with ALAT:

To borrow a loan from ALAT, follow these steps:

- Upgrade your account to a standard one by providing additional documentation.

- Apply for a loan through your dashboard and wait for processing.

Interest Rates:

The interest rate on your loan is determined by ALAT’s lending partners and will vary depending on the amount you borrow. However, ALAT will clearly show you the interest rate before you apply.

How Can I Contact ALAT?

If you have any questions or concerns, you can contact ALAT by:

- Visiting their office at 8 Idowu Taylor Street, Victoria Island, Lagos, Nigeria.

- Visiting their website at www.alat.ng

- Sending an email to [email protected]

- Calling them at 0700 2255 2528

Conclusion:

ALAT by Wema is revolutionizing the way we bank, offering a range of convenient services tailored to suit your financial needs. With ALAT, you can enjoy a digitalized banking experience like never before, all from the comfort of your smartphone.

FAQ:

1.Can I use ALAT if I don’t have a Wema Bank account?

Yes, you can! ALAT is open to everyone, regardless of whether you have an account with Wema Bank or not.

2.Is ALAT safe to use?

Absolutely. ALAT employs the latest security measures to ensure your personal and financial information is protected at all times.

3.Can I access ALAT from multiple devices?

Yes, you can access your ALAT account from multiple devices, as long as you have the mobile app installed and your login credentials handy