Loans are a common way for individuals and businesses to access money they need but don’t have readily available. Whether it’s for purchasing a home, starting a business, or covering unexpected expenses, loans can provide the necessary funds. However, understanding the different types of loans and their terms is crucial to making informed borrowing decisions.

What is a Loan?

In simple terms, a loan is money you borrow from a bank or financial institution with an agreement to pay it back, along with interest, over a specified period. The borrowed amount is called the principal, and the additional fee for borrowing is the interest. Loans are essential for the economy as they facilitate business growth and consumer spending.

Types of Loans:

Loans in Nigeria are typically classified into two main categories: secured and unsecured loans.

Secured Loans:

Secured loans require collateral, such as property or assets, to back up the loan. If the borrower fails to repay, the lender can seize the collateral to cover the debt. Common examples include mortgage loans, where the property serves as collateral, and term loans, which have fixed repayment terms.

Unsecured Loans:

Unsecured loans do not require collateral but rely on the borrower’s creditworthiness. Lenders assess the borrower’s financial records to determine eligibility. Personal loans and credit card loans are examples of unsecured loans, but they often come with higher interest rates due to the increased risk for the lender.

Other Categories of Loans:

Loans can also be classified based on repayment terms and interest rates:

- Single payment loans require repayment of the entire amount at once within a fixed timeframe.

- Monthly payment loans allow borrowers to repay gradually with fixed monthly installments.

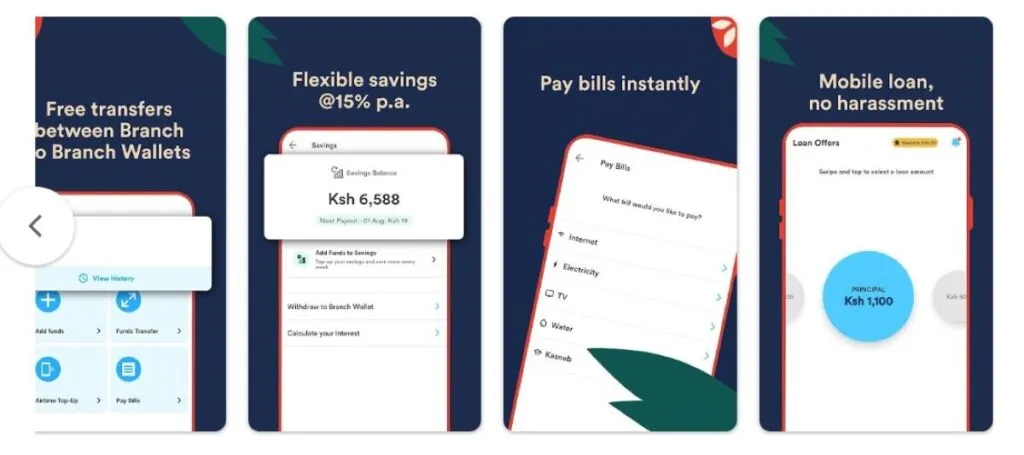

- Salary advance loans provide short-term financial assistance until the next paycheck.

- Fixed-rate loans maintain a constant interest rate throughout the loan term, while variable-rate loans’ interest rates fluctuate.

- Installment loans involve regular payments over an extended period, such as mortgages.

- Convertible loans offer flexibility to change between different loan types as needed.

Loan Considerations:

When choosing a loan, it’s essential to consider factors such as interest rates, repayment periods, and compound interest. Higher interest rates and longer repayment periods can result in more significant total repayment amounts. Compound interest, where interest is charged on both the principal and accumulated interest, can increase the overall cost of borrowing over time.

Conclusion:

While loans can provide immediate financial relief, they come with responsibilities and risks. It’s crucial to carefully evaluate your financial situation and borrowing needs before taking out a loan. Understanding the different types of loans and their terms can help you make informed decisions and avoid falling into a cycle of debt.

FAQs:

1.What is the difference between secured and unsecured loans?

Secured loans require collateral, while unsecured loans do not. Secured loans offer lower interest rates but involve the risk of losing collateral if repayment is not made.

2.How do interest rates affect loan repayment?

Higher interest rates result in higher total repayment amounts over the loan term. It’s essential to compare interest rates and choose the most favorable option.

3.What should I consider before taking out a loan?

Before borrowing money, consider your ability to repay the loan, interest rates, fees, and any potential risks associated with the loan. Make sure to read and understand the terms and conditions before signing any agreements