In recent years, the rise of microfinance banks has been a beacon of hope for small to medium-sized enterprises (SMEs) in Nigeria. Among these, AB Microfinance stands tall, boasting a rich history of success since its inception in 2002. With branches spanning across Lagos, Oyo, Ogun, and Ondo State, AB Microfinance is dedicated to enhancing financial accessibility throughout the nation.

What Are the Requirements for AB Microfinance Loans?

AB Microfinance simplifies the loan process to empower entrepreneurs. To apply for a loan, you’ll need:

- A valid ID card.

- Proof of business ownership.

- At least one guarantor.

- Flexible collateral arrangements based on loan size.

- Your business must operate within AB Microfinance’s lending areas (Lagos, Oyo, and Ogun State), and have a certain tenure.

Interestingly, you don’t need an existing account with AB Microfinance to secure a loan.

Services Offered by AB Microfinance

AB Microfinance offers two primary services: Savings & Account and Credit.

Savings & Account:

- AB Current Account: Enjoy unrestricted access to your funds with no maintenance fees and SMS alert services.

- AB Savings Account: Secure your funds while earning competitive interest rates, with easy access and simple account opening.

- AB Term Deposit Account: Lock in your money for a fixed duration and enjoy attractive interest rates.

Credit:

- Micro Loans: Access quick loans ranging from N15,000 to N3 million with flexible collateral arrangements and documentation requirements.

- SME Loans: Designed for SME owners, this service offers transparent and quick loans up to N20 million with collateral requirements.

- Housing Loans: Access loans for housing projects ranging from N300,000 to N3 million, along with quality building materials and expert advice.

E-banking:

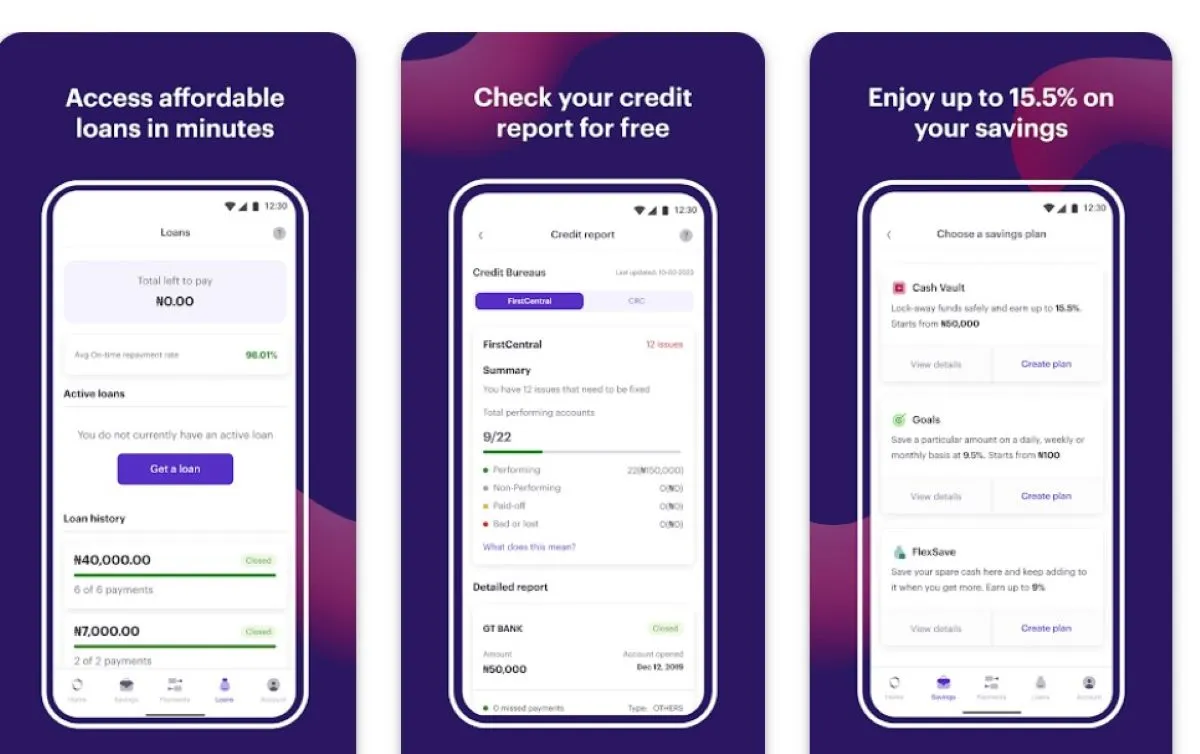

AB Microfinance offers convenient e-banking services including payments, mobile banking, instant fund transfer, debit/ATM cards, point of sale (POS), and NIBSS instant payment (NIP).

How to Borrow from AB Microfinance

If you meet the loan requirements, follow these steps to apply:

- Visit any AB Microfinance branch with necessary documents and a sizeable collateral.

- Your proposal undergoes on-site assessment and final approval by a decision committee.

- Loan disbursement time varies based on the loan amount.

A disbursement fee of 1% of the disbursed amount applies to all loans.

How Much Can You Borrow and What Are the Interest Rates?

AB Microfinance offers loans ranging from N15,000 to N20 million. The amount you can access depends on your repayment capacity, business assets, and other criteria.

Conclusion:

With AB Microfinance, accessing loans for your business has never been easier. With minimal documentation and flexible terms, entrepreneurs can take their businesses to new heights. Whether you’re a small business owner or an SME, AB Microfinance stands ready to support your financial needs.

FAQ:

-

What documents do I need to apply for a loan from AB Microfinance?

- You’ll need a valid ID, proof of business ownership, and at least one guarantor. Collateral requirements vary based on the loan size.

-

Do I need to have an account with AB Microfinance to get a loan?

- No, you don’t need an existing account to apply for a loan.

-

How long does it take to receive a loan from AB Microfinance?

- Loan disbursement time varies depending on the loan amount, with high-value SME loans typically taking a week