GTbank Salary Advance is a convenient financial solution offered by Guaranty Trust Bank (GTbank) to its employees, providing them with access to quick and hassle-free salary advances. There are various aspects of GTbank Salary Advance to look out for, including its benefits, features, and the application process.

Overview of GTbank Salary Advance

GTbank Salary Advance is designed to offer employees the flexibility to access a portion of their salaries before the regular payday. This service aims to address immediate financial needs, providing a reliable source of funds to cover unexpected expenses or emergencies.

Benefits and Features of GTbank Salary Advance

One of the key benefits of GTbank Salary Advance is its quick and easy accessibility, allowing employees to address urgent financial requirements without undergoing lengthy approval processes.

Additionally, the scheme offers competitive interest rates and flexible repayment terms, making it an attractive option for employees in need of short-term financial assistance.

How to Apply for GTbank Salary Advance

The application process for GTbank Salary Advance is straightforward and can be initiated through the bank’s designated channels. Employees can conveniently apply for the salary advance, ensuring a seamless experience when seeking financial support.

READ ALSO: Types of Loans In Nigeria

Eligibility and Requirements

GTbank Salary Advance is available to eligible employees who meet specific criteria and provide the necessary documentation.

Understanding the eligibility requirements and documentation is crucial for individuals considering this financial option.

Eligibility Criteria for GTbank Salary Advance

To qualify for GTbank Salary Advance, employees must meet certain eligibility criteria, which may include a minimum length of service with the bank, a consistent salary payment history, and compliance with the bank’s internal policies.

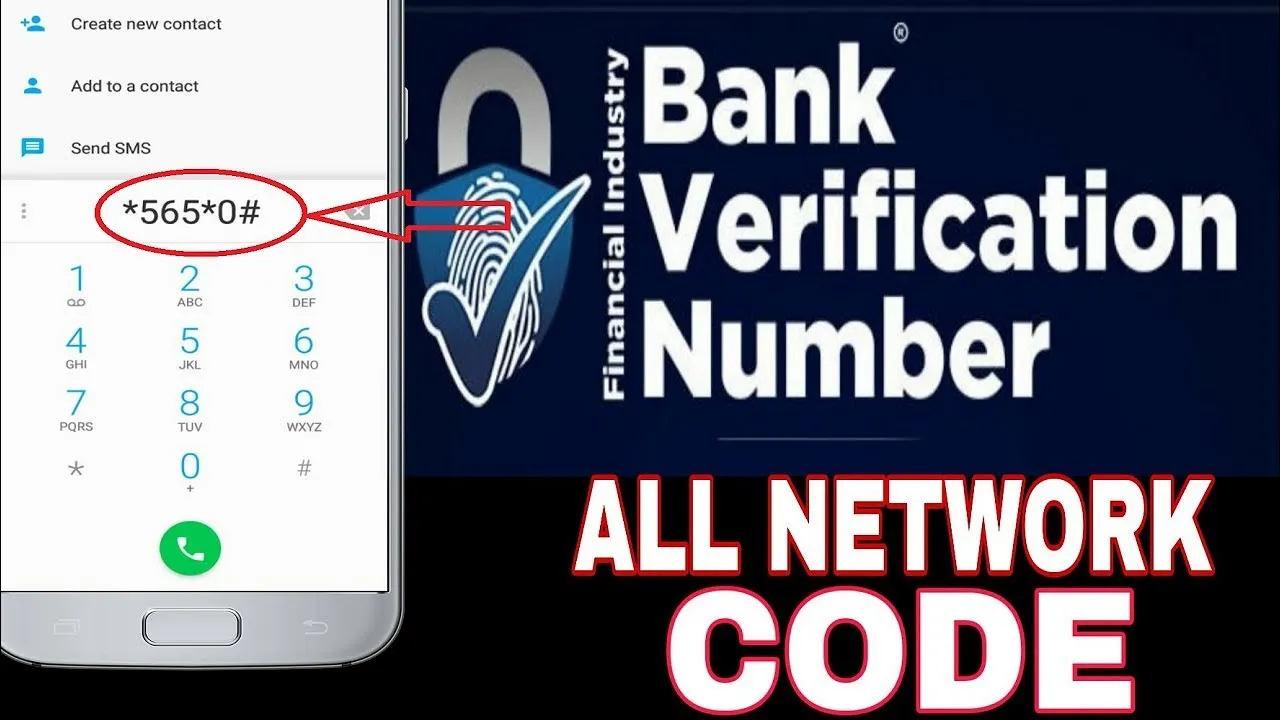

Documents Required for Application

When applying for GTbank Salary Advance, employees are typically required to submit specific documents, such as proof of employment, identification documents, and any additional paperwork stipulated by the bank.

Maximum Loan Amount and Repayment Terms

GTbank Salary Advance offers employees access to a predetermined maximum loan amount, which is subject to the individual’s salary and other relevant factors. The repayment terms are designed to accommodate the borrower’s financial capabilities, ensuring a manageable and sustainable repayment plan.

Application Process

The application process for GTbank Salary Advance involves several steps, and understanding the process is essential for employees seeking to avail themselves of this financial service.

Step-by-Step Guide to Applying for GTbank Salary Advance

Employees can initiate the application process by following a step-by-step guide provided by GTbank, which outlines the necessary actions and documentation required to complete the application successfully.

Online Application Process

GTbank offers an online application platform for Salary Advance, allowing employees to conveniently submit their applications through a user-friendly digital interface.

Required Information and Documentation

During the application process, employees will need to provide specific information and documentation to support their request for a salary advance. This may include personal details, employment information, and relevant financial documents.

SEE ALSO: Self Employed Loan in Nigeria

Repayment and Interest Rates

Understanding the repayment options and interest rates associated with GTbank Salary Advance is crucial for employees considering this financial solution.

Repayment Options and Schedule

GTbank Salary Advance offers flexible repayment options, allowing employees to choose a repayment schedule that aligns with their financial circumstances. The bank provides various methods for loan repayment, ensuring convenience and ease for borrowers.

Interest Rates and Scheme Details

GTbank Salary Advance features competitive interest rates, making it an attractive option for employees in need of short-term financial assistance. The scheme’s interest rates are designed to be fair and transparent, providing borrowers with a clear understanding of the cost implications.

Final Thoughts

GTbank Salary Advance presents a valuable financial solution for employees, offering accessibility, flexibility, and competitive terms.

The eligibility criteria, application process, and repayment details, will help employees to make informed decisions when considering GTbank Salary Advance as a means to address their immediate financial needs.