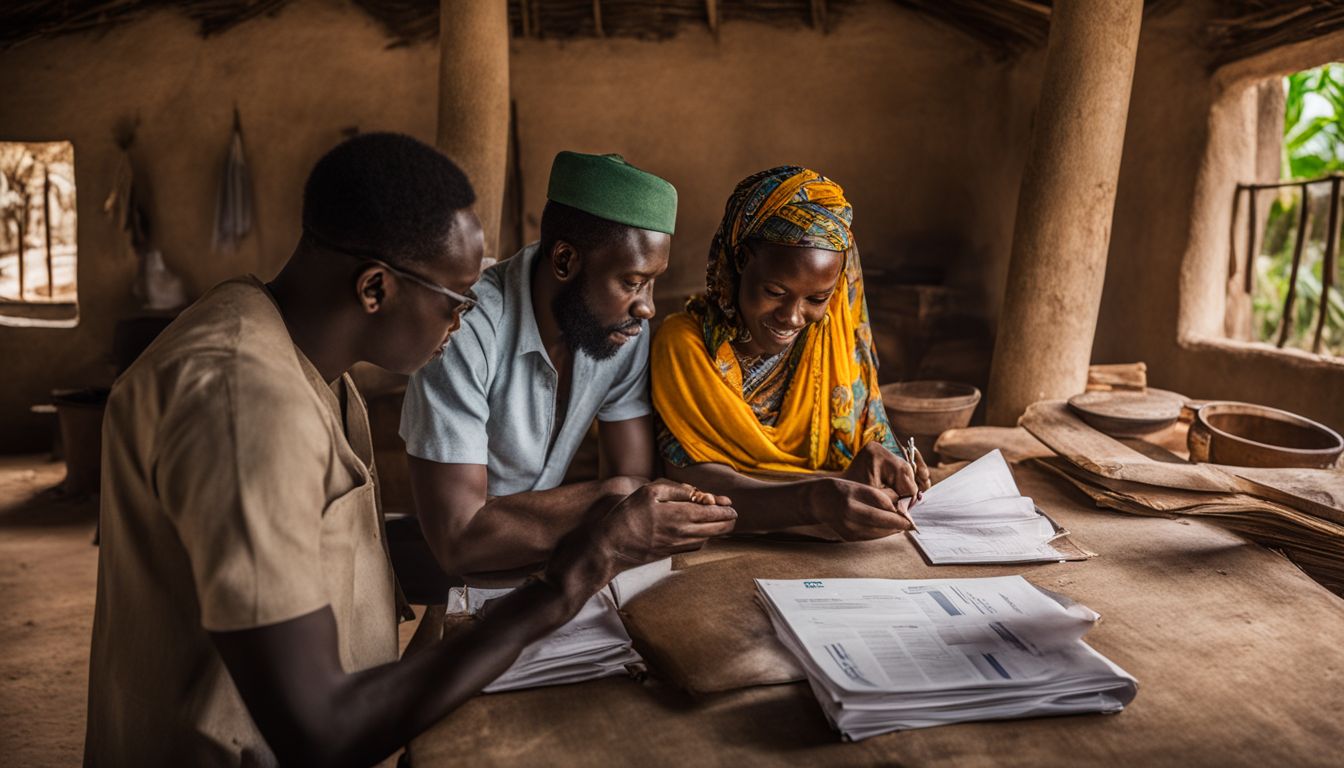

Getting loans in Nigeria can be tough, especially for farmers who need money to grow their crops or buy equipment. Many farmers face challenges when trying to get financial support.

One good thing is that the Federal Government of Nigeria offers low-interest loans to help farmers through the Agro-Financing program. We will show you steps on how to find and apply for these agricultural loans.

By the end, you’ll know about different loan types and how they can benefit your farming business. Keep reading to learn more!

Key Takeaways

- Farmers can find low – interest loans from the Federal Government of Nigeria and other sources to buy equipment or grow their crops. These loans come with benefits like better technology and more income.

- Different agricultural loan options are available for Nigerian farmers, including Bank of Agriculture loans, Commercial Agriculture Credit Scheme, Agricultural Credit Guarantee Scheme Fund, and the Sterling Agricultural Input Scheme.

- To apply for these loans, farmers should pick a reliable lender, gather all needed documents and financial info, and make sure they meet the criteria. Registration with the Corporate Affairs Commission is also key.

- Interest rates for these loans are generally favorable, with some going as low as 9 percent to make it easier for farmers to afford them. Repayment terms can vary but offer flexibility.

- The process includes identifying lenders like the Central Bank of Nigeria or the Bank of Agriculture that provide various funding supports for agriculture.

Benefits of Agricultural Loans for Farmers

Agricultural loans provide farmers with access to funds for expansion or improvements, leading to increased productivity and income. Farmers can also invest in modern technology and equipment, enhancing their operations.

Access to funds for expansion or improvements

Getting loans for farmers in Nigeria opens doors to fund expansion or make important improvements. With agricultural loans, you can buy more land, invest in new crops, or upgrade your farming equipment.

This helps your farm grow bigger and work better.

Loans also help you use modern technology and tools. You can get systems that save water or machines that harvest faster. This makes your farm more efficient and could increase what you earn from your crops and animals.

Increased productivity and income

Accessing agricultural loans in Nigeria can lead to increased productivity and income for farmers. With the funds obtained, farmers can invest in modern technology and equipment, thereby improving their efficiency and output.

Additionally, the ability to expand or make improvements on their farms will contribute to a higher yield, ultimately leading to increased income for smallholder farmers and agroallied entrepreneurs in Nigeria.

The Agricultural Credit Guarantee Scheme Fund (ACGSF) provides loans at a maximum interest rate of 9 percent, while the Central Bank of Nigeria has approved the disbursement of about ₦75 billion for agro-financing.

Ability to invest in modern technology and equipment

Farmers in Nigeria can leverage agricultural loans to invest in modern technology and equipment such as advanced irrigation systems, precision farming tools, and efficient machinery.

This investment enables them to improve productivity, reduce manual labor, and enhance the overall efficiency of their operations. With access to funds for farm innovations, smallholder farmers can embrace modern agricultural practices, ensuring a sustainable approach while increasing their income through higher yields and improved product quality.

By integrating modern technology into their farming methods, farmers can achieve operational excellence while contributing to the growth of the agricultural sector.

Nigerian farmers have the opportunity to upgrade their equipment by utilizing low-interest loans provided through initiatives like the Agricultural Credit Guarantee Scheme Fund (ACGSF) at a maximum interest rate of 9 percent, empowering them to adopt innovative solutions for enhanced productivity.

Additionally, federal programs offer funding for agroallied businesses which further widens the scope for accessing finance dedicated towards agricultural advancements and development.

Types of Agricultural Loans Available in Nigeria

Several options exist for agricultural loans in Nigeria, providing opportunities for farmers to access necessary financial support. These avenues include the Bank of Agriculture loans, Commercial Agriculture Credit Scheme, Agricultural Credit Guarantee Scheme Fund, and the Sterling Agricultural Input Scheme.

Bank of Agriculture loans

The Bank of Agriculture offers agricultural loans for Nigerian farmers. With over 50 years of experience and 110 outlets across Nigeria, it provides credit facilities to rural communities.

Farmers can easily access these loans by applying online or visiting the bank’s branches nationwide. The strategic zonal offices cater specifically to the needs of agricultural communities in Nigeria, making it easier for farmers to obtain the financial assistance they require.

Additionally, the Bank offers various loan programs tailored towards empowering smallholder farmers and developing the agriculture sector in Nigeria.

Commercial Agriculture Credit Scheme

The Commercial Agriculture Credit Scheme is a special fund by the Federal Government of Nigeria to enhance the agricultural sector. It provides long-term credit facilities at 9% interest rate, supporting commercial agricultural enterprises and smallholder farmers.

The scheme aims to boost productivity and income, enabling investment in modern technology and equipment for improved yields.

With over ₦75 billion allocated for agro-financing and strategic zonal offices across Nigeria, this scheme offers accessible funding opportunities for agricultural projects. Eligible entities can leverage this initiative to expand their farming operations and contribute to the growth of the agriculture sector in Nigeria.

Agricultural Credit Guarantee Scheme Fund

The Agricultural Credit Guarantee Scheme Fund (ACGSF) offers loans to eligible entities at a maximum interest rate of 9 percent. The fund is part of the federal government’s efforts to support and promote agriculture in Nigeria by providing financial assistance to farmers.

This initiative aims to boost agricultural productivity, income, and overall development in the sector. Farmers can tap into this scheme as a valuable resource for securing necessary funds to expand their operations and invest in modern technology and equipment, thereby enhancing their output and livelihoods.

Nigeria’s Agricultural Credit Guarantee Scheme Fund provides an opportunity for smallholder farmers to access credit facilities that can propel their agricultural activities forward.

Sterling Agricultural Input Scheme

The Sterling Agricultural Input Scheme provides financial support to Nigerian farmers, enabling them to acquire quality inputs such as seeds, fertilizers, and pesticides. This scheme aims to enhance agricultural productivity and boost yields for smallholder farmers across Nigeria.

With this initiative, farmers can access the resources they need to improve their farming practices and increase their income levels in an effort to contribute towards developing a sustainable agriculture sector.

Nigerian farmers can benefit from the Sterling Agricultural Input Scheme by obtaining crucial farm supplies that are essential for maximizing production and ensuring crop quality. This initiative aligns with the government’s commitment to supporting agricultural development and empowering smallholder farmers through targeted financing efforts.

How to Apply for Agricultural Loans in Nigeria

To apply for agricultural loans in Nigeria, identify a reputable lender and gather the necessary documents and financial information. Ensure you meet the eligibility criteria before proceeding with your application.

Identifying a reputable lender

Identifying a reputable lender is crucial. Look for credible institutions like the Bank of Agriculture with over 50 years of experience and strategic zonal offices across Nigeria. The Central Bank of Nigeria also offers agricultural loans through its accessible loan portal, while the Agricultural Credit Guarantee Scheme Fund provides loans at a maximum interest rate of 9 percent to eligible entities.

These lenders play vital roles in providing financial assistance for agricultural projects and empowering smallholder farmers in Nigeria.

Gathering necessary documents and financial information

Gather important documents like your identification, proof of ownership or lease for the farm, and business plan. Also, have your financial records ready, including bank statements, tax returns, and any existing loan information.

Make sure to prepare a detailed budget showing how you’ll use the agricultural loan.

Also Read:

Meeting eligibility criteria

To qualify for agricultural loans in Nigeria, ensure your farm business is registered with the Corporate Affairs Commission. Eligible applicants must also have a feasible business plan and possess collateral or guarantors depending on the loan type.

Additionally, farmers should be within the age range of 18 to 60 years and have a good credit history. Moreover, it’s essential to demonstrate your capacity for loan repayment through past income records and financial statements.

Keep in mind that specific lenders may have additional eligibility criteria, so research thoroughly before applying.

Frequently Asked Questions About Agricultural Loans

Got questions about agricultural loans? Learn about the approval process, repayment terms, interest rates, loan amounts, and collateral requirements. Need more information on agricultural loans in Nigeria? Keep reading to get the answers you need!

Approval process

To apply for agricultural loans in Nigeria, you need to follow a straightforward approval process. After identifying a reputable lender, gather necessary documents and financial information.

Meet the eligibility criteria set by the lender or financial institution offering the loan. Once your application is approved, you can access funds for farming activities or agribusiness projects.

Nigerian farmers can also benefit from low-interest loans offered by the federal government to help them grow their agricultural ventures.

The Agricultural Credit Guarantee Scheme Fund (ACGSF) provides loans at a maximum interest rate of 9 percent, while the Central Bank of Nigeria has approved about ₦75 billion for agro-financing.

Repayment terms

Repayment terms for agricultural loans in Nigeria vary but typically range from 6 months to 5 years. The interest rates are usually between 5-9 percent, with the Agricultural Credit Guarantee Scheme Fund (ACGSF) providing loans at a maximum interest rate of 9 percent.

Farmers can access different types of loans such as direct loans, guaranteed loans, and microloans, allowing for flexibility in repayment options. Additionally, the Central Bank of Nigeria has approved the disbursement of about ₦75 billion for agro-financing, ensuring adequate funding support for farmers in meeting their repayment obligations.

Interest rates

The Agricultural Credit Guarantee Scheme Fund (ACGSF) provides loans to eligible entities at a maximum interest rate of 9 percent. Additionally, the federal government of Nigeria offers low-interest loans to farmers through the Agro-Financing program.

These programs aim to support farmers with favorable interest rates, making agricultural financing more accessible and affordable for smallholder farmers. The Central Bank of Nigeria has approved the disbursement of about ₦75 billion for agro-financing, showcasing its commitment to providing affordable financial assistance for agricultural development in Nigeria.

By offering low-interest loans, these initiatives help farmers access the capital they need without facing hefty interest charges that could burden their operations and hinder growth.

Loan amounts and collateral requirements

Farmers in Nigeria can access varying loan amounts depending on the program or institution they apply to. The Agricultural Credit Guarantee Scheme Fund, for instance, provides loans up to a maximum of 9 percent interest rate.

Furthermore, the Central Bank of Nigeria has approved ₦75 billion for agro-financing. Collateral requirements may differ between lenders and types of loans but are essential for securing agricultural financing.

It’s important to note that farmers can apply for direct loans, guaranteed loans, and microloans specifically tailored towards agricultural purposes through various government schemes and financial institutions across Nigeria.

Conclusion: Access to agricultural loans can help Nigerian farmers grow and contribute to the development of the agriculture sector, leading to a stronger economy and improved livelihoods for farmers.

Accessing agricultural loans in Nigeria is crucial for farmers’ growth and the sector’s development. By applying for various loan schemes offered by the government and financial institutions, farmers can secure funds for expansion, technology adoption, and improved productivity.

Identifying reputable lenders and meeting eligibility criteria are key steps in securing these loans. The practicality of these strategies ensures that Nigerian farmers can easily navigate the loan application process to bolster their agricultural endeavors.

Embracing these approaches not only empowers farmers but also catalyzes economic growth and enhances livelihoods across Nigeria’s farming communities.

FAQs

1. How can farmers in Nigeria get loans for farming?

Farmers in Nigeria can apply for agricultural loans through various programs such as the Federal Agriculture Empowerment Program, microfinance institutions, and banks offering agribusiness funding.

2. What are smallholder farmer loans?

Smallholder farmer loans are special types of financial assistance designed to help small farm owners manage their farm finance and invest in agricultural development.

3. Can I get a loan for an agricultural project in Nigeria?

Yes, there are several loan programs available for farmers in Nigeria that provide funding for agricultural projects, including government agricultural loans and rural finance options.

4. What is needed to apply for an agricultural loan in Nigeria?

To apply for an agricultural loan, you typically need to complete an agricultural loan application process which may include providing details about your farm business plan, proof of land ownership or lease, and how you plan to use the loan.

5. Are there any guarantees required for farming loans?

Some farming loans might require a loan guarantee or collateral; however, certain government-backed schemes and microfinance options offer more flexible terms specifically designed to support smallholder farmers without strong financial backing.